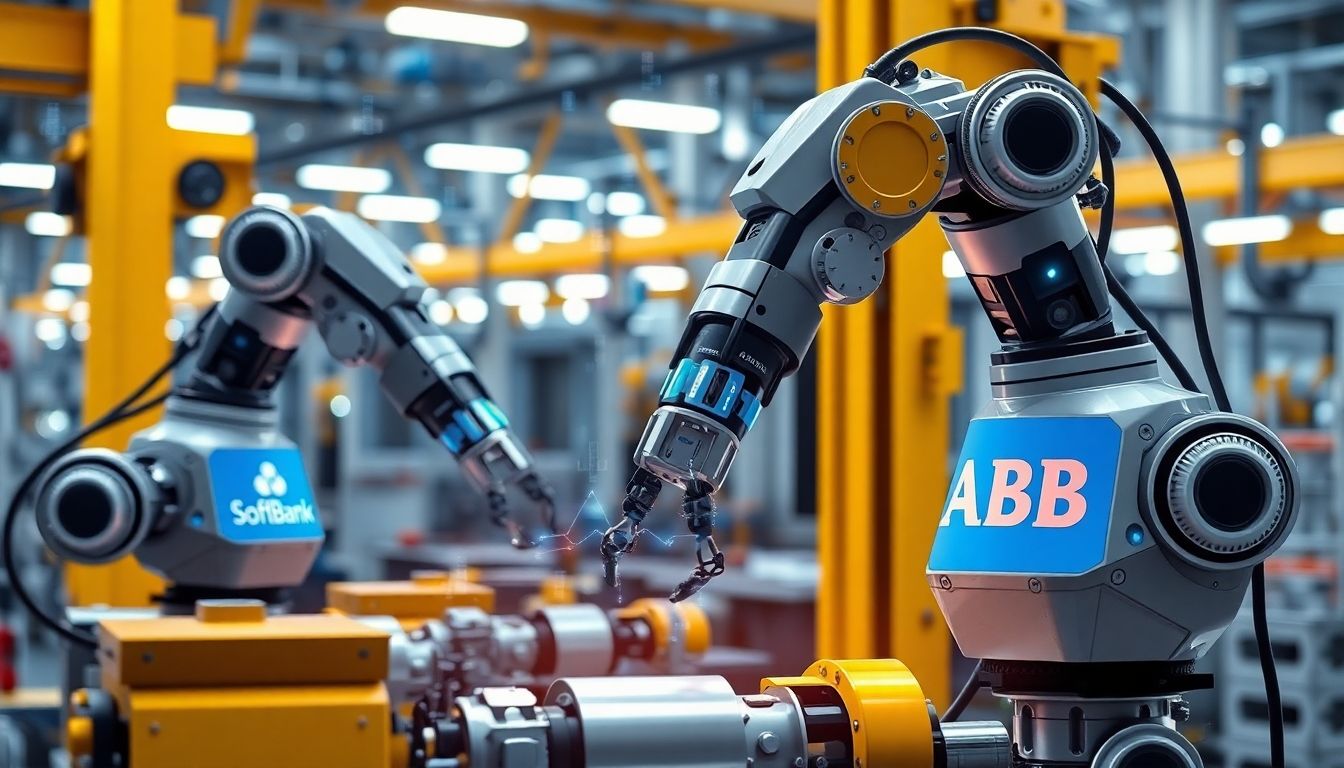

Japanese tech conglomerate SoftBank has agreed to purchase ABB’s robotics unit for $5.4 billion, marking one of the year’s most significant technology acquisitions and a major step forward in the global race to integrate robotics and artificial intelligence (AI).

Key Takeaways

SoftBank to acquire ABB’s entire robotics unit for $5.4 billion

Acquisition supports SoftBank’s strategy to advance ‘physical AI’

Deal expected to be finalised by mid-to-late 2026, pending approvals

ABB to restructure its operations and reassign parts of its automation division

The Deal: Advancing ‘Physical AI’

SoftBank’s acquisition of ABB’s robotics division is designed to profoundly accelerate the fusion of robotics with next-generation AI. SoftBank’s chairman and CEO, Masayoshi Son, described the move as a leap towards ‘physical AI’, combining world-class robotics engineering with advanced artificial intelligence. This strategic shift underscores SoftBank’s vision of a future where machines and AI revolutionise how industries and societies operate.

ABB’s Restructuring and Strategic Rationale

ABB, a major player in automation and robotics, originally considered spinning off its robotics business into a separate listed company. Now, following the agreement with SoftBank, ABB will treat the robotics division as discontinued operations in its financial reports from late 2025. Its machine automation segment will be reassigned to enhance process automation, ensuring that ABB remains focused on core areas while benefitting from the sale proceeds.

ABB’s leadership noted that the deal enables both companies to pool expertise in AI and robotics. This partnership is expected to unlock new applications and cement leadership in technology innovation during a crucial era for industrial digitalisation.

SoftBank’s Expansion Strategy

SoftBank’s acquisition forms part of a wider strategy to establish itself at the forefront of intelligent automation and AI. Alongside its high-profile investments in other technology sectors, this move cements the group’s commitment to physical robotics. Son characterised it as an evolution that brings ‘artificial super intelligence’ together with advanced machine design, aiming to “propel humanity forward.”

Recent SoftBank investments—such as a $2 billion stake in chipmaker Intel—demonstrate a broader pattern: targetting critical components and capabilities in the AI and robotics ecosystem.

Timeline And Next Steps

The transaction is subject to customary regulatory approvals and completion conditions. Both companies anticipate closing the deal during 2026. In the interim, ABB’s robotics operations will be prepared for the transition, while SoftBank lays groundwork to integrate this major asset with its AI initiatives.

Industry Implications

This acquisition highlights growing competition and investment in robotics and automation as global markets race to harness AI advancements. Experts predict that alliances such as this will accelerate innovation and could transform sectors ranging from manufacturing to logistics, healthcare, and beyond.